Planning Your Healthcare: Compare 2024 Medicare Plans for Better Coverage – With the arrival of 2024, it’s essential to review and compare Medicare plans to ensure optimal coverage. This article provides a comprehensive guide to help you navigate the various options and make informed decisions for better healthcare.

<meta name=Planning Your Healthcare: Compare 2024 Medicare Plans for Better Coverage>

Plan Your Healthcare Wisely: Compare 2024 Medicare Plans for Enhanced Coverage 🩺

Greetings, Smart People!

As we embark on a new year, it’s crucial to prioritize our healthcare and make informed decisions about our Medicare coverage. With the arrival of 2024, various Medicare plans are available, each offering unique benefits and coverage options. Navigating through these plans can be daunting, but with careful consideration and comparison, you can find the plan that best suits your needs and ensures optimal healthcare coverage.

Opening the Door to Better Healthcare: The Significance of Comparing Medicare Plans 🚪

Choosing the right Medicare plan is essential for several reasons:

1. Tailored Coverage: Every individual has unique healthcare needs. By comparing plans, you can select one that aligns with your specific medical requirements, ensuring you receive the necessary coverage for your well-being.

2. Cost Control: Medicare plans vary in terms of premiums, deductibles, and copayments. Comparing plans allows you to find one that fits your budget and minimizes out-of-pocket expenses.

3. Provider Network: Medicare plans have different networks of healthcare providers. Comparing plans enables you to choose one that includes your preferred doctors, ensuring continuity of care.

4. Additional Benefits: Some Medicare plans offer additional benefits such as dental, vision, or hearing coverage. Comparing plans helps you identify those that provide the extra benefits you desire.

5. Peace of Mind: Knowing you have the right Medicare coverage can provide peace of mind and allow you to focus on your health rather than worrying about coverage gaps or unexpected expenses.

Delving into the World of Medicare Plans: An Overview 🔎

Medicare offers various plans to meet the diverse needs of individuals. These plans include:

1. Original Medicare: This plan consists of Part A (hospital insurance) and Part B (medical insurance). It provides basic coverage for hospitalization, medical services, and certain preventive care.

2. Medicare Advantage Plans (Part C): These plans are offered by private insurance companies and provide comprehensive coverage that includes Original Medicare benefits, as well as additional benefits like dental, vision, and hearing coverage.

3. Medicare Part D: This plan provides prescription drug coverage. It is available as a standalone plan or as part of a Medicare Advantage plan.

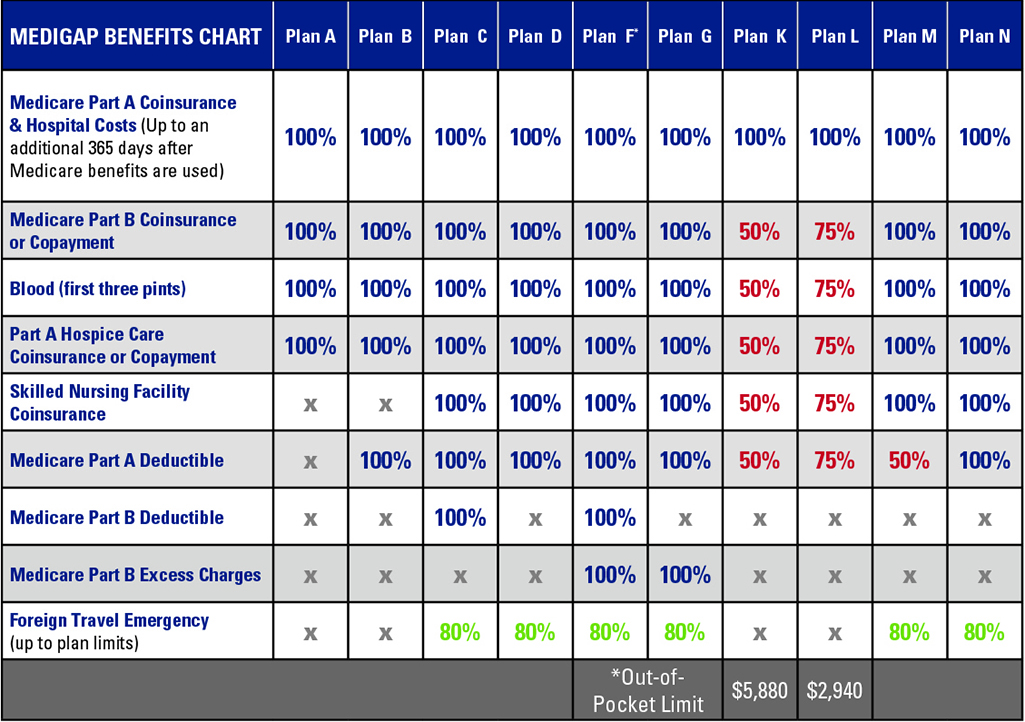

4. Medigap Policies: These policies are supplemental insurance plans that help cover out-of-pocket costs not covered by Original Medicare or Medicare Advantage plans.

Unveiling the Strengths of Medicare Plans: A Path to Comprehensive Coverage 💪

Medicare plans offer several strengths that contribute to better healthcare coverage:

1. Comprehensive Coverage: Medicare plans provide comprehensive coverage for a wide range of healthcare services, including hospitalization, medical care, prescription drugs, and preventive care.

2. Flexibility: Medicare offers various plan options, allowing individuals to choose the plan that best suits their needs and budget.

3. Access to Quality Care: Medicare plans have networks of healthcare providers who meet specific quality standards, ensuring access to high-quality care.

4. Affordability: Medicare plans are generally affordable, with various options available to meet different financial situations.

Addressing the Weaknesses of Medicare Plans: Mitigating Potential Challenges ⚖️

While Medicare plans offer numerous strengths, it’s essential to acknowledge their potential weaknesses:

1. Limited Provider Networks: Some Medicare Advantage plans have limited provider networks, which may restrict access to certain healthcare providers.

2. High Out-of-Pocket Costs: Medicare plans may have high out-of-pocket costs, such as deductibles, copayments, and coinsurance, which can be a financial burden for some individuals.

3. Complex Enrollment Process: The Medicare enrollment process can be complex, and individuals may encounter difficulties navigating the various options and making informed decisions.

4. Lack of Dental and Vision Coverage: Original Medicare does not typically cover dental and vision care. These services may be available through Medicare Advantage plans or supplemental insurance.

| Original Medicare | Medicare Advantage Plans | Medicare Part D | Medigap Policies | |

|---|---|---|---|---|

| Plan Type | Government-run plan | Private insurance plans | Prescription drug coverage plan | Supplemental insurance plans |

| Coverage | Hospital and medical care | Comprehensive coverage, including Original Medicare benefits | Prescription drug coverage | Out-of-pocket costs not covered by Original Medicare or Medicare Advantage plans |

| Flexibility | Limited | High | Moderate | High |

| Provider Networks | Vast | Limited | Varies | Varies |

| Out-of-Pocket Costs | Moderate | Varies | Varies | Low |

| Enrollment Process | Relatively simple | More complex | Moderate | Relatively simple |

Frequently Asked Questions (FAQs) About Planning Your Healthcare

-

What is the best Medicare plan for me?

The best Medicare plan depends on your individual needs, health status, and budget. Compare plans to find one that provides comprehensive coverage at an affordable cost.

-

When can I enroll in a Medicare plan?

The Medicare Open Enrollment period typically runs from October 15 to December 7 each year. During this time, you can enroll in, change, or drop Medicare plans.

-

What is the difference between Original Medicare and Medicare Advantage plans?

Original Medicare consists of Part A (hospital insurance) and Part B (medical insurance), while Medicare Advantage plans are private insurance plans that provide comprehensive coverage, including Original Medicare benefits.

-

What is Medicare Part D?

Medicare Part D is a prescription drug coverage plan that helps cover the cost of prescription medications.

-

What are Medigap policies?

Medigap policies are supplemental insurance plans that help cover out-of-pocket costs not covered by Original Medicare or Medicare Advantage plans.

-

How can I compare Medicare plans?

You can compare Medicare plans using online tools, talking to a licensed insurance agent, or contacting Medicare directly.

-

What are the benefits of comparing Medicare plans?

Comparing Medicare plans allows you to find the plan that best suits your needs, budget, and healthcare goals.

-

How can I enroll in a Medicare plan?

You can enroll in a Medicare plan during the Open Enrollment period or during a Special Enrollment Period if you qualify.

-

What is the cost of Medicare plans?

The cost of Medicare plans varies depending on the plan type, coverage level, and your location.

-

Can I change my Medicare plan?

Yes, you can change your Medicare plan during the Open Enrollment period or during a Special Enrollment Period if you qualify.

-

What are the penalties for not having Medicare coverage?

If you are eligible for Medicare and do not have coverage, you may have to pay a late enrollment penalty.

-

Where can I get help with Medicare?

You can get help with Medicare from the Social Security Administration, Medicare.gov, or a licensed insurance agent.

-

What is the future of Medicare?

The future of Medicare is uncertain, as there are ongoing debates about how to reform the program and ensure its long-term viability.

Empowering You to Make Informed Decisions: Taking Action for Better Healthcare ✊

Planning your healthcare and comparing